oregon tax payment address

Minnesota Department of Revenue Mail Station 5510 600 N. However any taxes owed must still be paid by April 15.

State Of Oregon Oregon Department Of Revenue Home

Guide to Oregon prevailing wage rates and resources to follow the law.

. You can also request an automatic extension to file by this date. Affordable Care Act Requires Insurance Companies to Justify High Rate Hikes Health insurance premiums have risen rapidly straining pocketbooks for American families and businesses. Department of the Treasury Internal Revenue Service Ogden UT 84201-0002.

Box 802501 Cincinnati OH 45280-2501. Some employers began withholding the tax in. Since 1999 the health insurance premiums for family coverage have risen 131 percent.

Youll pay tax on your home to your state and local government if. Find a crop or livestock insurance agent in your area along with directions to their office. Add Another Bill.

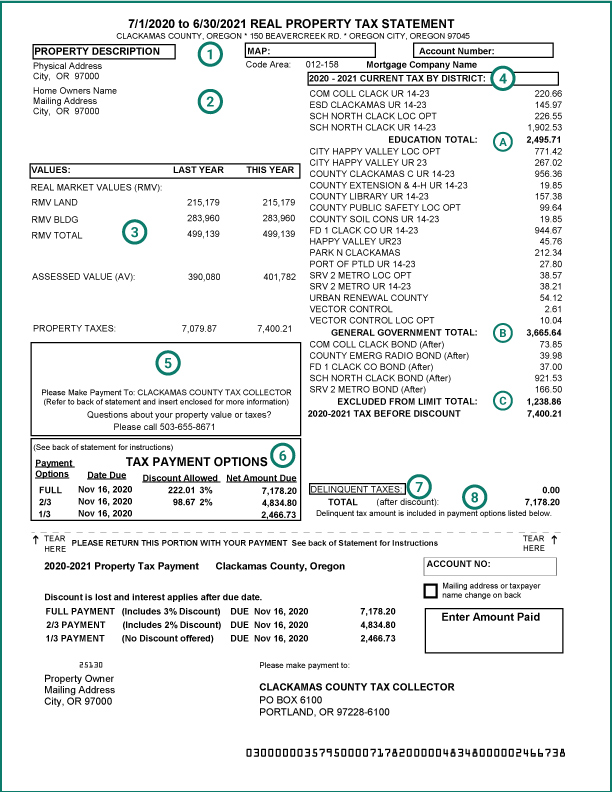

Tax statements are sent to owners by October 25th each year. A foreign country US. This financial assistance can be used to permanently abandon repair or replace a water well used for household purposes.

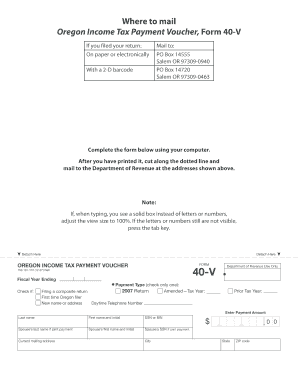

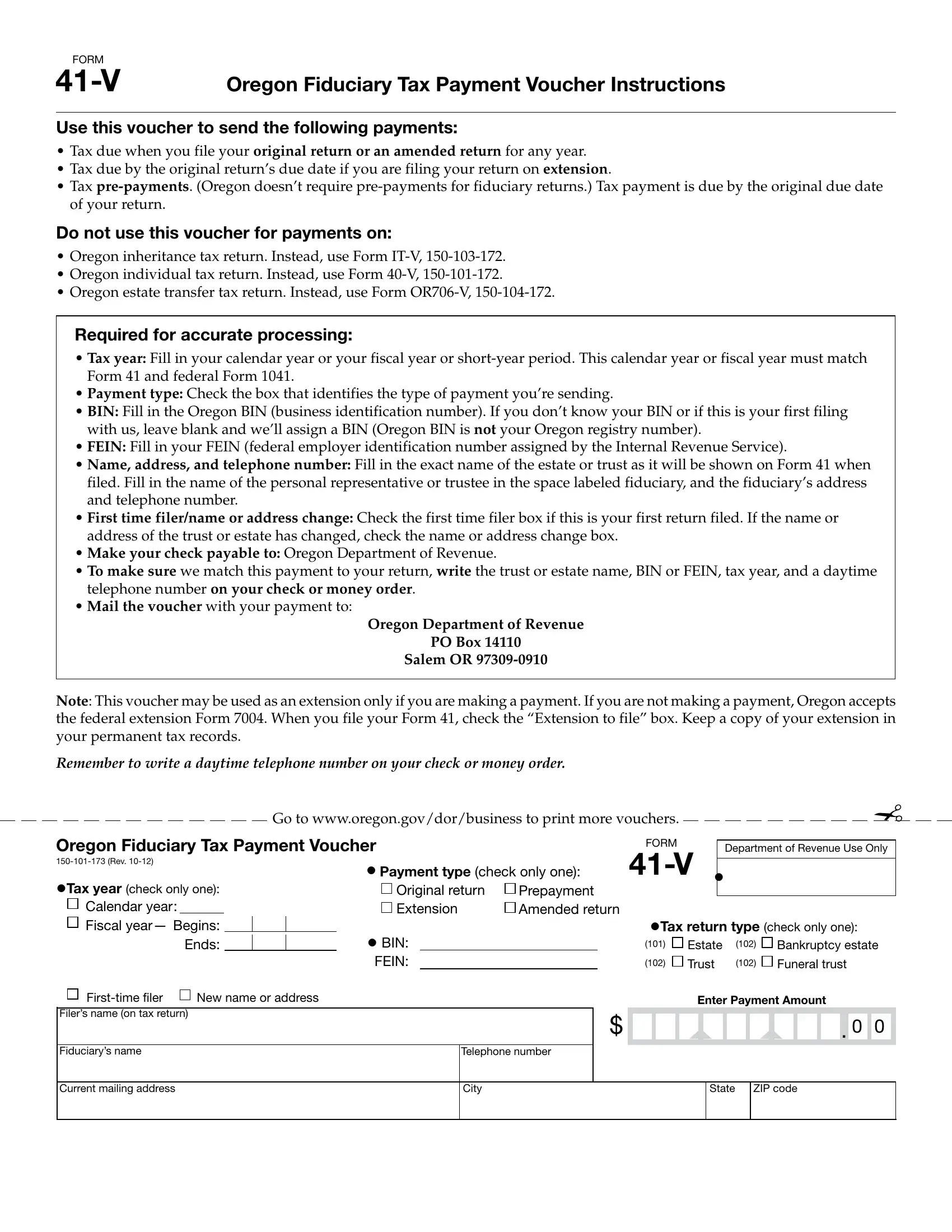

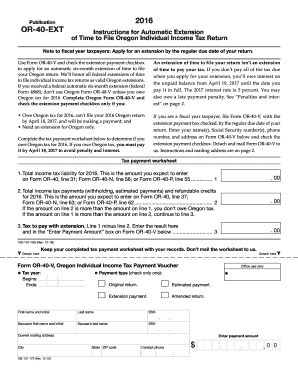

Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Payment type check one Use UPPERCASE letters. This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK. Salem OR 97309-0463.

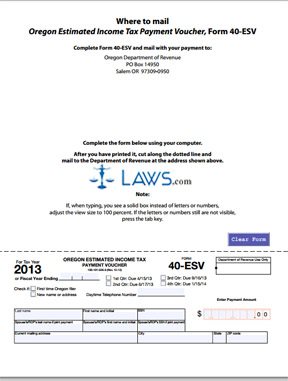

We last updated the Income Tax Estimated Payment Vouchers and Instructions in January 2022 so this is the latest version of Form IT 1040ES fully updated for tax year 2021. Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries. Heres what you need to look out for.

And you are enclosing a payment then use this address. Contained in the saving clause of a tax treaty to claim an exemption from US. Whatcom County sits in the northeast corner of Washington State along the Canadian Border.

Typically the local FSA office is located in the same building as the local NRCS office. Without 2D Barcode see Form OR 1040. Youll pay for two costs each month in your monthly mortgage payment.

Internal Revenue Service PO. Address Line 2. Tax on certain types of income you must attach a statement to Form W-9 that specifies the following five items.

Contractors and subcontractors must submit the name and address work classification the number of hours worked each day the pay rate gross amount paid deductions and net amount paid the hourly equivalent amount contributed to any party plan or program for fringe. Print actual size 100. Oregon property taxes are assessed for the July 1st to June 30th fiscal year.

Generally the deadline to file US Individual Income Tax returns is April 15. Paul MN 55146-5510 Street address for deliveries. Current mailing address Rev.

Possession or territory or use an APO or FPO address or file Form 2555 or 4563 or are a dual-status alien. Use this address if you are not enclosing a payment Use this address if you are enclosing a payment. And you are not enclosing a payment then use this address.

More complex issues are discussed in Publication 15-A PDF and tax treatment of many employee benefits can be found in Publication 15. 04 Spouses last name City Contact phone Spouses SSN Initial State. Estimated tax payments must be sent to the Ohio Department of Revenue on a quarterly basis.

Department of the Treasury Internal Revenue Service Austin TX 73301-0215 USA. Const FP featured_posts_nonce76c9f46ca0featured_postsdescriptionHow these Latinx and Black founders leveraged their stories to put. October 15 is the last day to file tax returns for those who requested.

Starting in January of 2022 Metro employers are required to withhold the tax through payroll deductions for employees who earn more than 200000 annually or for employees who opt into having the tax withheld. Get the right guidance with an attorney by your side. The median annual property tax payment in the county is just 1768.

Internal Revenue Service PO. Important Dates Installment Options Postmarks. Dont get scammed this holiday season.

Due Dates for 2022 - 2023 Tax Payments. Oregon Department of Revenue. Use blue or black ink.

The Whatcom County average effective property tax rate is 085 compared to the Washington State average of 093. Our network attorneys have an average customer rating of 48 out of 5 stars. It has property tax rates well below the state average.

The FCIC promotes the economic stability of agriculture through a sound system of crop insurance. Oregon Department of Revenue. 9 Twitter alternatives like Mastodon and Hive Social in case the social network shuts down on Elon Musks watch or you just want to quit King was one of the first boldface names threatening to leave Twitter if Musks plan to have verified users pay 20 a month later reduced to 8 to.

Premium increases have forced families to spend more money for less coverage. Twitters only advertiser will soon be MyPillow. Publication 15 PDF provides information on employer tax responsibilities related to taxable wages employment tax withholding and which tax returns must be filed.

Get the latest local Detroit and Michigan breaking news and analysis sports and scores photos video and more from The Detroit News. When finished click the Continue button and you will be asked to review the information for accuracy before your payment is processed. And you are filing a Form.

Dont submit. Regulators are leaning toward torpedoing the Activision Blizzard deal. An extension of time provides an extra six months to file your return.

The first payment is due by November 15th. Minnesota Department of Revenue Individual Income Tax. Salem OR 97309-0460.

2D Barcode Amount Due. Heres Elon Musks response. Payroll Withholding Tax Requirements Metro Supportive Housing Services SHS Personal Income Tax.

Generally this must be the same treaty under which you claimed exemption from tax as a nonresident alien. Mail your property tax refund return to. If you live in Oregon.

A farm tract number. An official tax ID Social Security number or an employer ID A property deed or lease agreement to show you have control of the property. If you dont have a farm tract number you can get one from USDAs Farm Service Agency.

Indicates a required field. We recommend employers download these. Minnesota Department of Revenue Mail Station 0020 600 N.

Address Line 1. November 15th Tuesday 2022 February 15th Wednesday 2023. The Water Well Abandonment Repair and Replacement Fund WARRF provides financial assistance to individual households or members of a federally recognized tribe in Oregon.

Oklahoma City OK 73126-0800. Paul MN 55145-0020 Mail your tax questions to.

Fillable Online Services Oregon 2007 Form 40 V Oregon Income Tax Payment Voucher 150 Services Oregon Fax Email Print Pdffiller

Where S My Refund Oregon H R Block

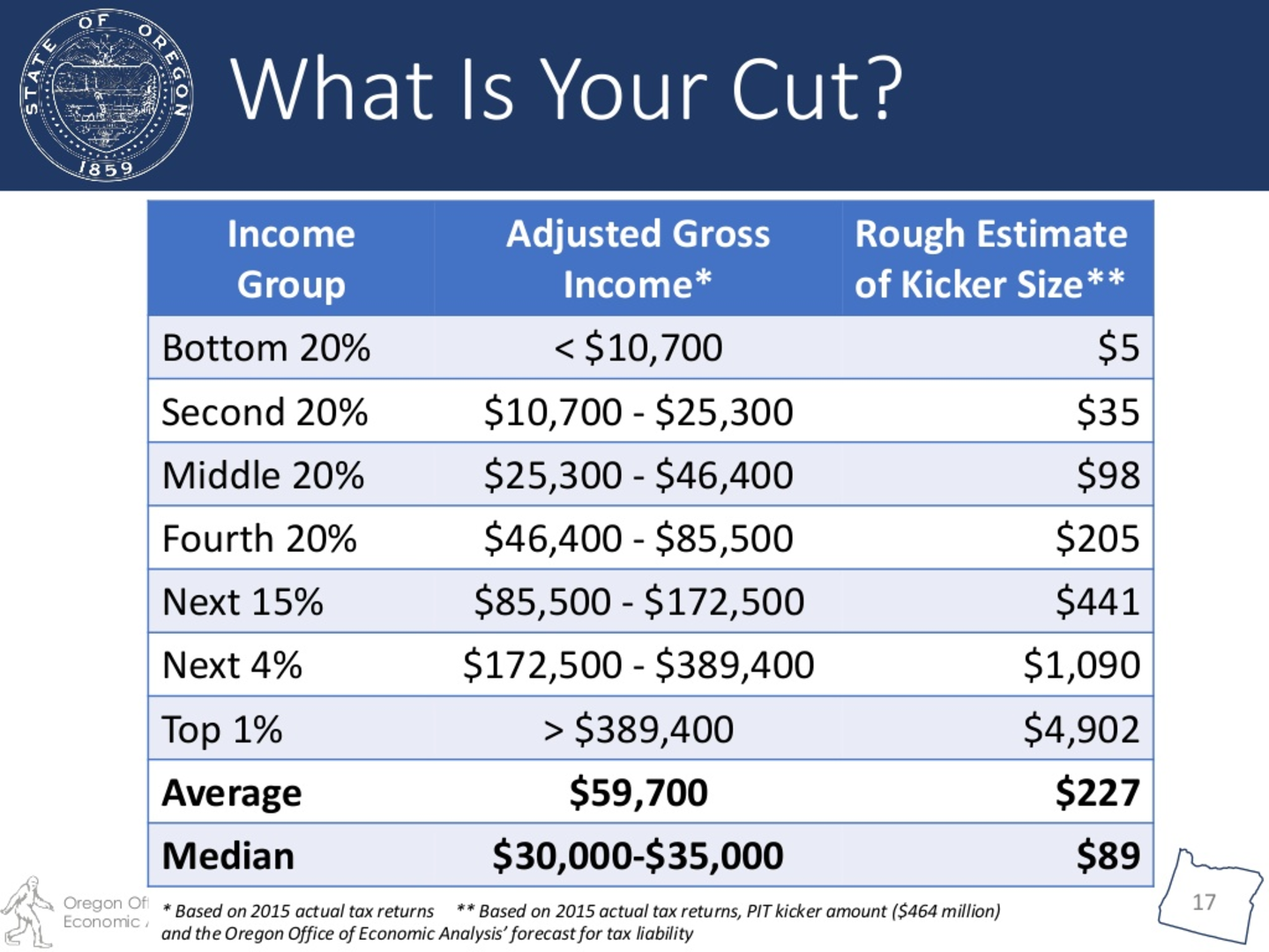

Federal Stimulus Could Mean Higher Oregon Tax Katu

Understanding Your Property Tax Bill Clackamas County

Free Form 40 Esv Estimated Income Tax Payment Voucher Free Legal Forms Laws Com

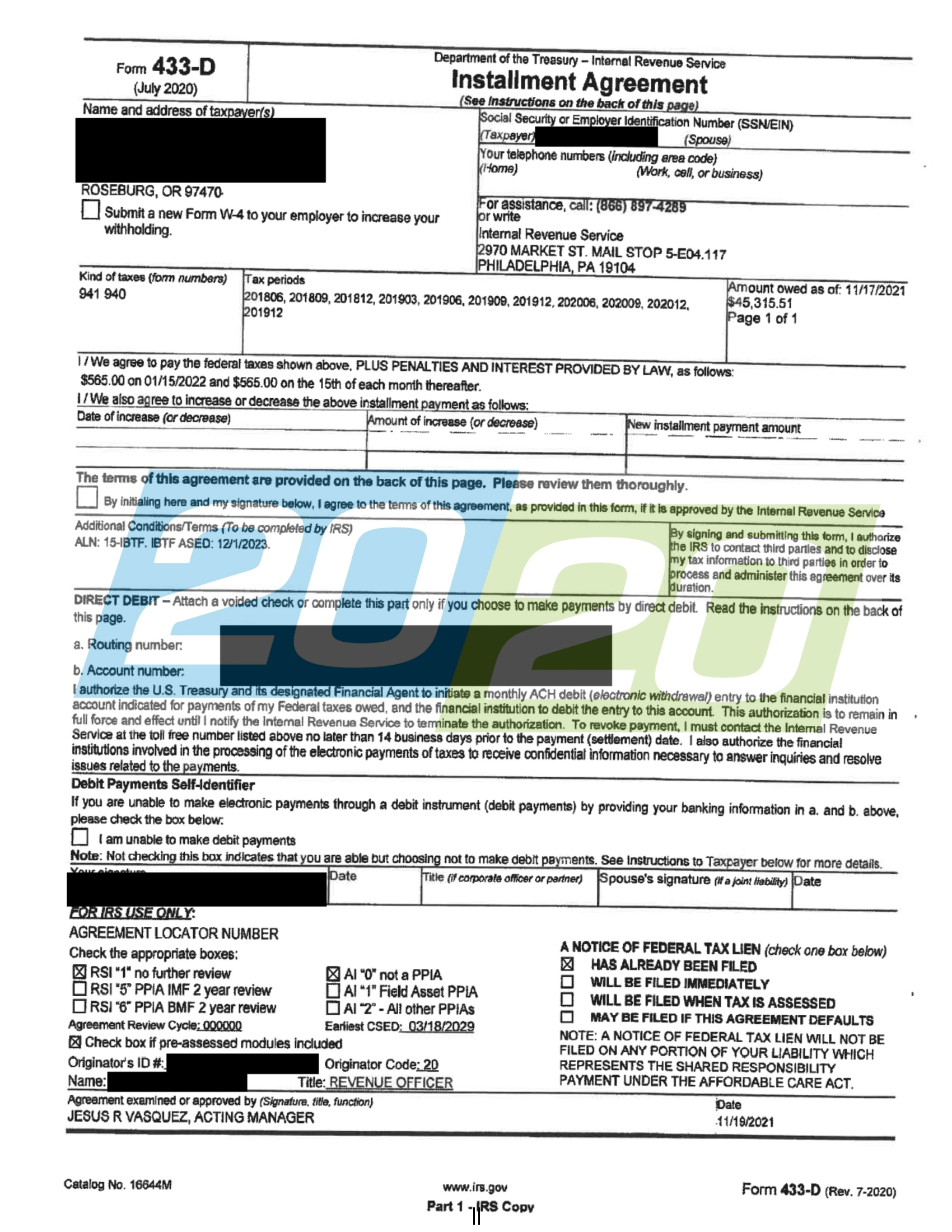

Tax Successes In Oregon 20 20 Tax Resolution

Lodging Tax Payments Benton County Oregon

It S Time To Fix Oregon S Regressive Tax Structure Oregon Center For Public Policy

The Oregon Department Of Revenue Has Now Granted Relief To Oregon Taxpayers Larry S Tax Law

E File Oregon Taxes For A Fast Tax Refund E File Com

Property Tax Statement Guide Multnomah County

Oregon Form 41 V Fill Out Printable Pdf Forms Online

Here S The Kicker Oregonians To Receive A Tax Rebate In 2018 Opb

2020 Tax Return Notices To Be Aware Of Go Green Tax

Form 40 Esv Instructions Oregon 40 V Income Tax Payment Voucher 150 101 026 Fill Out And Sign Printable Pdf Template Signnow

Columbia County Oregon Official Website Tax Office

Oregon Collects 25 5m In Taxes On Recreational Marijuana Through July 31 2016 Kpic

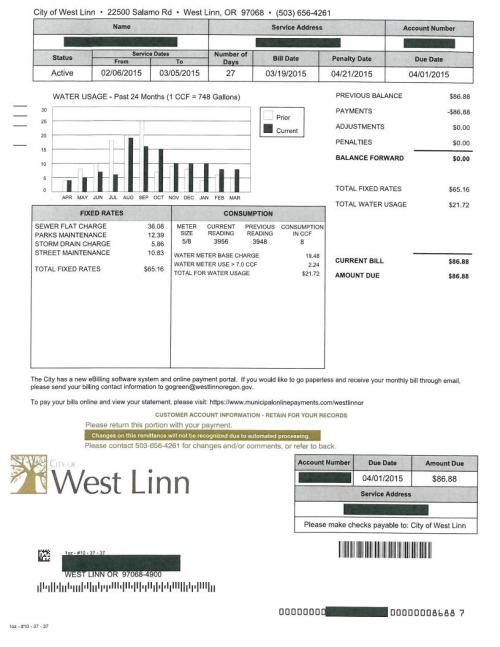

Paying Your City Services Bill A K A Utility Bill City Of West Linn Oregon Official Website